Pay an Annual Voluntary Honor Tax to Wiyot

Committing to

Pay an Annual Voluntary Honor Tax to the Wiyot people.

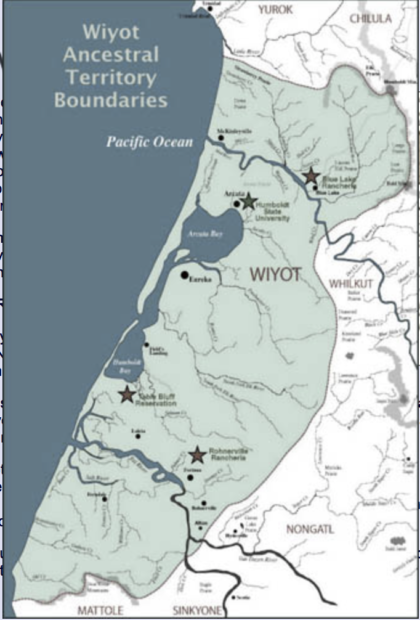

The Fellowship is located on their

Ancestral lands

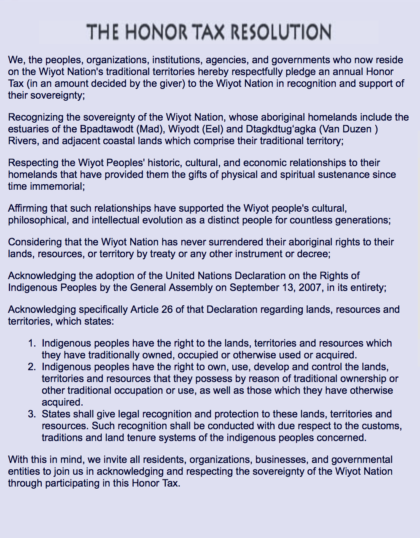

Information from 7th generation website – I open with this statement from – Michelle Vassel, Wiyot Tribal Administrator: “Tribal governments provide essential service to their citizens. Other governments tax property, land, and income in order to provide these services. Tribal Governments cannot do this as their ancestral territory is occupied. We cannot tax our own people because they are already paying local, state, and federal taxes and tribal lands are held in trust by the federal government, or being taxed by other governments. The Wiyot Tribe operates primarily on grant funding. That places Tribes in a position of being subject to the whims of the federal government and nonprofit foundations which often dictate how funds must be spent. For me, the Honor tax is a really important tool to develop economic sovereignty because it allows us to choose how we spend funds with no strings attached.” – Michelle Vassel, Wiyot Tribal Administrator

The website of Cooperation Humboldt states “An Honor Tax is a tangible way of honoring the sovereignty of Native Nations. It is called a tax because it’s not a gift or donation. The tax is voluntary… “the amount is decided by the individual or business or other organization… and is paid directly to the Wiyot Tribe.”

Cooperation Humboldt has chosen to commit a voluntary Honor Tax of 1% of their annual revenue.

https://cooperationhumboldt.com/wiyot-honor-tax/

Others have suggested an amount relevant to the value of their home or property, perhaps a portion of the value as assessed by the county or the amount of their annual property tax, or even a portion of their rental payments.

By consensus vote, our Fellowship congregation has committed to pay an Honor Tax to the Wiyot Tribe as one small way to honor our use of unceded Wiyot territory.

HUUF began our Honor Tax contributions to the Wiyot Tribe in 2019 and will continue to give annually for the years to come.

As individuals, please considering your own voluntary payments of an Honor tax.

You can mail your payment to the address

The Wiyot Tribe

1000 Wiyot Dr.

Loleta, CA. 95551

We will hear some say that an “Honor Tax is a tax, not a donation.” I suggest that the value in this view is that we are encouraged to accept this honoring of native peoples as an obligation. Similarly we honor our obligation to the Humboldt Unitarian Universalist Fellowship with our pledge dollars.

So we can say that an Honor Tax is both a tax and a tax-deductible contribution. The following is from the Wiyot Tribe’s official acknowledgement of a donation:

“RE: Honor Tax

On behalf of the Wiyot Tribe I would like to say Hu’ (thank you) for your donation of $(amount) made (date).

“The Wiyot Tribe is a federally recognized Indian Tribe, as such your Honor Tax donation may be claimed as a tax deduction. This letter serves to acknowledge your donation for that purpose.”

The acknowledgment letter then quotes IRS code at length. Here I present the most relevant sentences from IRS:

“Congress authorized federally recognized Indian tribes and their political subdivisions to be treated like states for certain specified purposes because tribal governments, like state governments, serve the public within their jurisdictional boundaries, and accordingly, should be permitted to devote their limited resources to that end…

“As a result, of being an Indian tribe described in IRC Section 7871 a federally recognized tribe and/or its political subdivision is determined by the IRS to be an organization to which contributions may be tax deductible, as provided in IRC Section 170.”

https://www.irs.gov/government-entities/indian-tribal-governments/itg-faq-2-answer-are federally-recognized-tribes-considered-organizations-to-which-charitable-contributions-are-tax deductible